Getting business vehicle insurance is crucial when you use vehicles or involve regular drivers to run your business in South Africa. Many road accidents happen in this country from small car incidents to big collisions. The truth is more than 50 percent of vehicles in this country remain uninsured,

Accidents may happen unexpectedly and when you do not have coverage for this emergency condition, it can be a daunting process to manage the payment. Costs often skyrocket when it links to vehicle damage. Aside from road accidents, there is a possibility of fire, theft, and third-party claims.

Fortunately, business vehicle insurance can save you from that worse possibilities. Numerous insurance companies offering coverage for a business vehicle are available out there. The key is you must get the most suitable insurance that fits your business needs and existing budget..

Best Commercial Vehicle Insurance in South Africa

South Africa is renowned for its efficient and reliable insurance industry. You can discover numerous companies offering business vehicle insurance in this country.

If you are looking for the best insurers to cover vehicles when doing their commercial purposes, you can consider these top-notch insurance companies.

a. King Price Insurance

King Price takes the first position in all insurance types in South Africa. It also becomes a leading insurance company that provides coverage for business vehicles with its proactive claims service. King Price has commercial insurance to cover all the stuff you require to stay in the business.

Its business insurance team understands that you face various risks, challenges, and threats every day. Hence, the team is ready and can cover the unique needs of your business vehicle insurance. Business clients are the main priority of the team. They serve the clients similarly to give them peace of mind.

With the royal service, the team will help you to get coverage directly or get business vehicle insurance from the broker. Clients also can benefit from successful collaboration because King Price establishes an open, honest, and transparent relationship.

The team of claims specialists is ready to help you anytime and anywhere through every step of the insurance payment. They will keep you up-to-date with the latest information during the entire process of getting a business vehicle insurance quote.

What is covered by King Price?

- Medical expenses up to $106.60 per injured occupant

- The loss and damage of motorized vehicles are stated in the policy schedule including spare parts and accessories.

- Tire damage.

- Waiver or third-party rights.

- Liability to others.

- Cross liabilities.

- Fire extinguishing charges, and

- Principals.

Benefits of using King Price:

- Fast and easy claims.

- Lower premiums.

- Emergency helps.

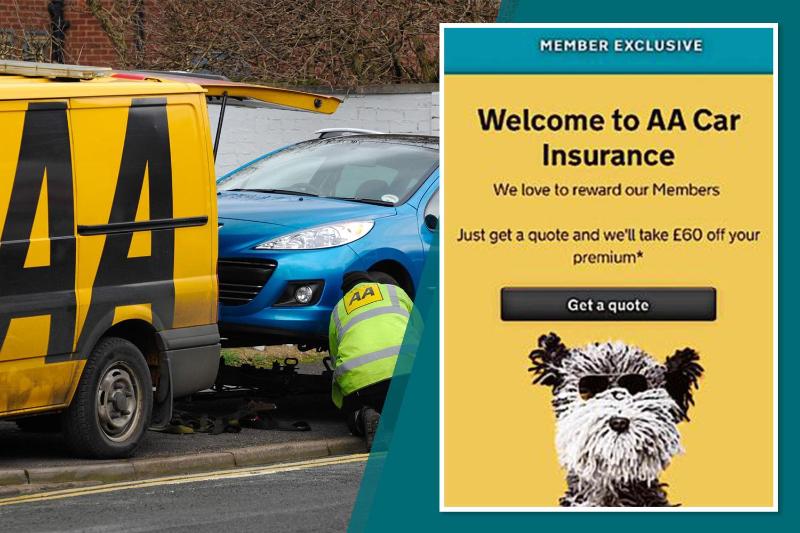

b. AA Car Insurance

As one of the top-notch insurers in South Africa, AA comes with three primary types of car insurance. It also provides a list of products you can add to the business vehicle insurance package. It offers lower premiums and meets the car insurance needs of elders over 60 years old with its specifically-designed package.

AA car insurance allows you to access over 30 benefits such as medical rescue, accident towing, roadside rescue, and many others. Armed response services are available so you can discuss business vehicle insurance anytime and anywhere through mobile phones, IoT devices, or Bluetooth devices.

Experienced in the insurance industry for over 90 years, AA has fully understood its clients’ needs. Therefore, it gives advice, guidance, and assistance with all things related to personal and business cars. You can choose a business vehicle insurance package based on your needs because it comes in various options.

AA has played a significant role in the lives of road users and business people. No matter what business you run, AA will help you to select an insurance package and adjust it to your conditions and budget. Prices for business vehicle insurance depend on the type of package chosen and membership status.

What is covered by AA Insurance?

- 50 percent off on excess payments is available.

- No excess payments for AA Quality Assured repairer.

- Unlimited call-outs every 12 months.

- Emergency medical rescue.

- Roadside rescue.

- Comprehensive support service.

Benefits of using AA Insurance:

- Affordable premiums.

- Well-experienced and trusted insurer.

- Excellence insurance services.

- An independent insurance broker.

- Expert insurance advice.

- No payment for the Advice fee and initial service.

- Continuous support for insurance products.

c. Momentum

Momentum is also the best business vehicle insurance in South Africa as it belongs to the top three list. This company offers three types of insurance and provides optional extras to add to the insurance coverage. It comprises no hidden costs and guarantees the premiums within a year no matter whether you claim it or not.

Momentum provides short-term cover for you who want to get business vehicle insurance to protect yourself, your employees, and your business. You can get this coverage through affordable, comfortable, and reliable insurance options. This coverage keeps your possessions remain safe when accidents happen.

This insurance company promotes competitive solutions adjusted to meet your unique business needs. It helps you to protect your business from unexpected events and handle claims professionally and quickly. Its business vehicle insurance protects any vehicle used in daily business operations including the drivers.

When you feel safe in unexpected events, you have the confidence to handle the situation well. It is the aim of this insurance company when providing business vehicle insurance. Momentum wants you to always feel safe on the roads when conducting business activities.

What is covered by Momentum?

- Car insurance at the retail venue.

- Premiums depend on individual needs with three levels of coverage.

- Up to 30 percent cash back on Safety Bonus for good driving behavior.

- Free home and roadside assistance are available 24/7.

Benefits of using Momentum:

- No requirement for driver nomination as it applies on a regular driver basis.

- A simple and quick way of claim submitting through a mobile app.

- Innovative technology featuring a safety alert button.

Choosing business vehicle insurance with a good reputation is essential to protect your vehicle and employees on the roads while handling business purposes. The best insurance companies in South Africa provide various types of coverage so clients can choose the best coverage for their business needs.